Explore the dynamic and rapidly evolving world of metal building industry as we delve into a comprehensive analysis of the top ten significant statistics shaping its current landscape.

Diving straight into the heart of the matter, the metal building industry is a dynamic and rapidly evolving sector, teeming with intriguing statistics that underscore its significance and growth.

This article will present you with the top 10 vital statistics that shape the metal construction industry today.

The market size of the metal building industry was $492.53M in 2022

Here’s why that’s a big deal:

- Eco-friendly: The world’s getting greener, and metal buildings are leading the way. They last longer and can be recycled!

- Affordable: These buildings don’t break the bank. More value for less money? Yes, please!

- Tech-savvy: Advancements in tech mean better and more versatile metal structures. Talk about an upgrade!

- City Growth: With cities expanding fast, quick-to-build metal structures are all the rage.

It is expected to reach $1094.22M by 2030

Worldwide projections unveil a bright future for the metal building industry – by 2030, experts anticipate that the market value will catapult to an impressive $1094.22 million. This prediction showcases the expanding appetite for metal construction technology, driven by its undeniable efficiency benefits.

From cost-effectiveness to incredible durability, the qualities inherent to metal building components undoubtedly fuel this market surge. Notably, the forecasted market value takes into account all relevant market segments, including residential, commercial, and industrial applications.

The metal building industry’s CAGR is estimated at 9.2%

Experiencing significant growth, this sector posted a Compound Annual Growth Rate (CAGR) of roughly 9.2%. This robust expansion symbolizes the increasing demand for metal constructions, marking vital progress within the industry.

An upward trend of this magnitude not only showcases the sector’s resilience but also highlights its capacity to adapt to evolving market demands, promising a prosperous future for the industry.

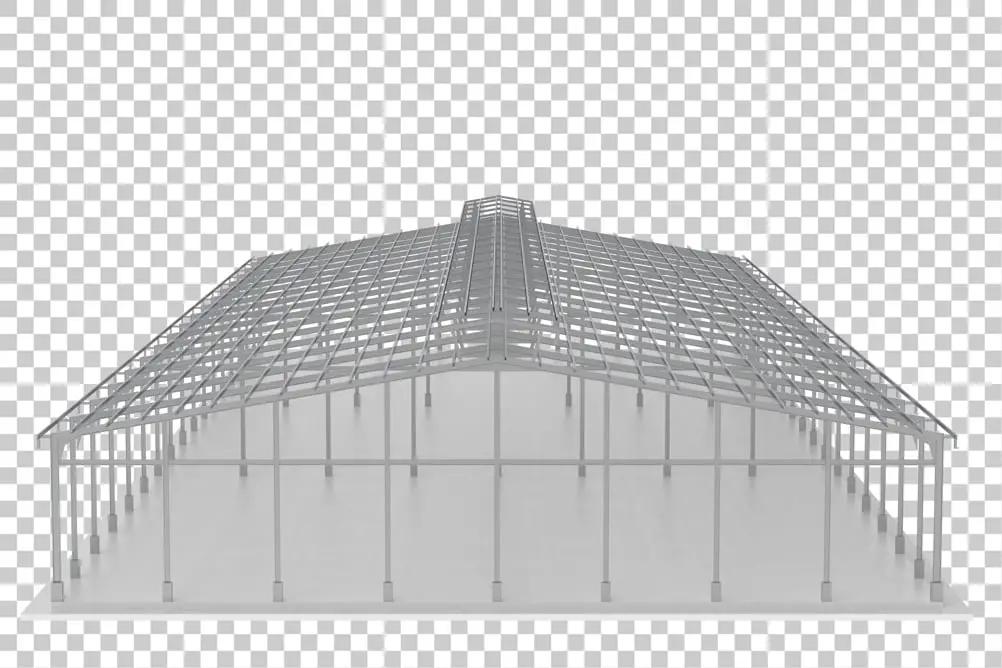

Steel is the main component of the metal building construction industry

Commonly used for its excellent strength-to-weight ratio, rust resistance, and affordability, steel consistently ranks as the predominant material in the industry.

It’s integral to various construction processes, including both load-bearing structures and aesthetic detailing.

Due to these characteristics, along with its recyclability, the reliance on steel remains strong and is not expected to wane in the foreseeable future.

62.2% of metal building projects are under 10,000 square feet

Continuing with the industry analysis, a significant percentage of metal constructions are compact projects. Latest findings indicate that 62.2% of all undertakings fall within a more modest size range — specifically, under 10,000 square feet.

These projects typically include small industrial buildings, personal storage units, or agricultural structures. These projects’ popularity can be attributed to their cost-effectiveness and the relative speed at which they can be completed, while still providing the same resilient and durable qualities inherent in metal constructions.

This data provides not only valuable insights into the existing market trends but also potential opportunities for manufacturers and builders leveraging these segments.

Steel consumption will reach 23.2 million metric tons annually by 2025

Forecasts indicate a significant increase in the demand for this versatile material. This growth is expected, considering the sturdy, durable, and cost-effective nature of steel, making it a staple in the building industry.

By 2025, the consumption of steel is projected to exceed the mark of 23.2 million metric tons annually. Such an increase could further energize the industry, simultaneously fostering innovation in sustainable manufacturing processes to meet growing needs while minimizing environmental impact.

There were an estimated 120k employees in the metal manufacturing industry in 2023

The year 2023 marked a significant point in the employment records of the metal manufacturing industry. An estimated workforce of 120,000 signified the market’s impressive resilience and growth.

It also underscored the industry’s vital role in job creation and economic stability. This figure is indicative of the industry’s robust capabilities, reinforcing its vital role in the national economy.

There were 3,344 metal building companies active in 2023

In 2023, the industry’s reach spanned a substantial total of 3,344 active entities. These companies, ranging in size and scope, significantly contributed to the overall sector growth and market competition.

Their active engagement played a pivotal role in shaping their respective regional markets while simultaneously accelerating the industry’s global expansion.

The presence of these companies cemented the industry’s status as a major player in the broader construction market.

The companies paid $8.0B in wages in 2023

With a total exceeding $8 billion in the year 2023, wages paid out by the metal building industry demonstrated a robust commitment to its workforce. This figure showcases the industry’s significant direct contribution to the economy, affirming the sector’s capacity for wealth generation and distribution to its employees.

By offering competitive salaries, it also indicates the industry’s endeavor to attract and retain highly skilled professionals. The correlation between this wage bill and the quality of products and services should not be overlooked: committing substantial funds to workforce remuneration typically translates to enhanced industry performance.

The average salary in the industry was $66.7k in 2023

Located toward the higher end of salaries across industries, employees within the metal building industry saw an impressive mean annual wage of $66,700 during 2023.

This high earning capacity is largely due to the necessity of specialized skill sets within the sector, setting it apart economically.

Moreover, this figure also reflects the increasing demand and growth rate in the industry, enabling better compensation for those opting for careers in metal building construction.

References

- https://www.coherentmarketinsights.com/

- https://byjus.com/

- https://www.metalconstructionnews.com/

- https://www.statista.com/

- https://www.ibisworld.com/

Recap